Homeowners Insurance in and around Martinsburg

Looking for homeowners insurance in Martinsburg?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Hedgesville

- Spring Mills

- Inwood

- Shepherdstown

- Charles Town

- Kearneysville

- Berkeley Springs

- Harpers Ferry

- Charleston

- Fairmont

- Morgantown

- Bridgeport

- Clarksburg

- Berkeley county

- Jefferson County

- Marion County

- Monongalia County

- Harrison County

- Kanawha County

- Morgan County

- Ranson

What's More Important Than A Secure Home?

One of the most important precautions you can take for your family is to get homeowners insurance through State Farm. This way you can slow down knowing that your home is taken care of.

Looking for homeowners insurance in Martinsburg?

The key to great homeowners insurance.

Protect Your Home Sweet Home

From your home to your prized pictures, State Farm can help you protect what you value most. Jarrod Furgason would love to help you know what insurance fits your needs.

When your Martinsburg, WV, residence is insured by State Farm, even if the worst comes to pass, your most valuable asset may be covered! Call or go online now and see how State Farm agent Jarrod Furgason can help you protect your home.

Have More Questions About Homeowners Insurance?

Call Jarrod at (304) 707-3493 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Help conquer home humidity problems with these tips

Help conquer home humidity problems with these tips

High home humidity is not only uncomfortable, it can also threaten your home’s structure and surfaces. Help clear the air with tips on how to reduce indoor humidity.

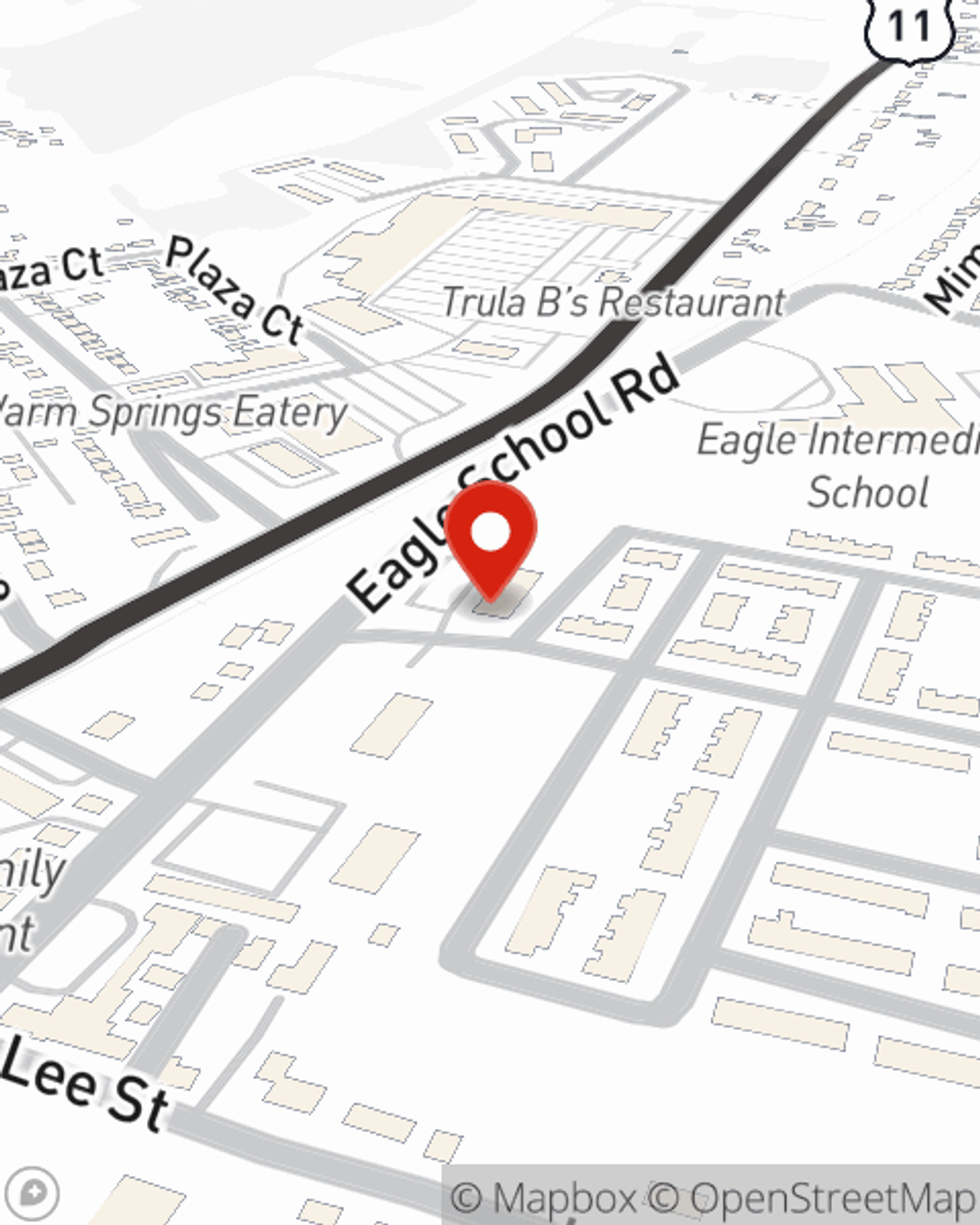

Jarrod Furgason

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Help conquer home humidity problems with these tips

Help conquer home humidity problems with these tips

High home humidity is not only uncomfortable, it can also threaten your home’s structure and surfaces. Help clear the air with tips on how to reduce indoor humidity.